A recent study shows that over 80% of Americans are in debt. High interest credit cards, hospital bills, or student loans, car payments — everyone knows the challenge.

We've done the research and found some of the best options on the internet that can help you get rid of debt starting today. Some are free, the rest are upfront with their pricing.

Make sure to grab at least 2 of these today before some of these offers could expire, they're all free to check!

1. Relieve $20k+ in Credit Card Debt With This Special Debt Relief Program (Enroll Before Friday)

Credit card companies don't want you to know this, but they can't stop you from doing it either…

Still unknown to Americans in heavy debt is a brilliant nationwide debt relief program that could help millions of Americans, providing relief of at least $20,000 in credit card debt without requiring a new loan.

You could bet the banks and credit card companies aren't too thrilled about losing all that profit from their high interest credit cards and might secretly hope you don't learn about it.

These savings could help pay for rent or your mortgage, home improvements, business ventures, or even vacations. With credit card interest rates soaring, many Americans are using this debt relief method to tackle at least $20,000 of debt, and checking eligibility is free with no signup fees. It takes just minutes to check.

See if you can get rid of $20,000+ in Credit Card Debt Today

How To See If You Are Eligible

If you have at least $20K in credit card debt, this takes minutes and is free to check!

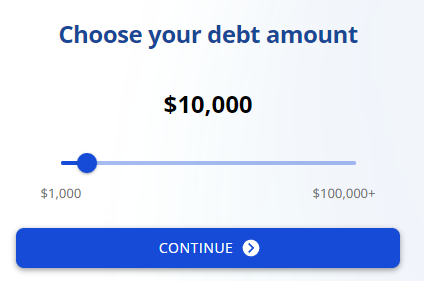

Step 1: Tap your debt amount below↓

Step 2: Fill out the quick form to find out how much you could potentially save

Step 3: Speak to a friendly representative.

This program can even help with debt amounts over $50,000 or $100,000!

2. Use This New Rule for Drivers to Save Up to $1,025 Annually

“I Lowered Our Insurance By 75%. I Dropped My Old Insurance For Not Telling Me About This. I Only Wish I Found Out About This Sooner.” – Susan

New policies are indicating that for years many American drivers have likely overpaid on their car insurance.

The simple truth is your car insurance company doesn't want you to know this.

Did you know, if you drive less than 50 miles/day and live in a qualified zip code you can get an extremely high discount. Additionally, depending on your age you can get even higher discounts by clicking here. Has your insurance agent ever told you that?

The problem is that insurance agents are paid on commission and incentivized to sell drivers the highest possible rate to increase their paycheck. MASSIVE discounts and policies as low as $38/month.

As an authority on everything insurance, we decided to put this service to the test and after entering our zip code and driver information we were shocked at this example.

So, what is the one new rule? NEVER buy insurance without comparing all of the discounts online first.

Note: You're NEVER LOCKED into your current policy. If you've already paid your bill, you can very easily cancel, and be refunded your balance.

With average savings of 32%, these online services are gaining massive popularity. You should know a trusted, secure, and effective free online service to check your discounts is this special program.

There Are Hundreds Of Auto Insurers. Which Has The Best Rate For You? What Kind Of Discounts Are There?

Step 1) Select your state.

Step 2) On the next page, enter your zip and some basic info. You’ll get instant rate comparisons tailored to you, with discounts!

Step 3) Save hundreds, and pocket the difference!

3. Homeowners Could Get Over $264,350 in CASH in March Using the Lucrative "CoRP" Option12

Don't expect banks to tell you this, but they can't stop you from doing it either...

Still unknown to many is the nationwide Cash Out Refi Program (CoRP) that could benefit millions of homeowners and allow them to access up to $264,35012 in cash (some qualify for even more!) to use however they'd like! You could bet the banks aren't too thrilled about losing all that profit from high interest loans and might secretly hope you don't find out before this option ends.

Homeowners are paying for their home renovations, funding their business, paying off debts & even taking vacations - All thanks to this "cash out" option that is now available. Inflation is through the roof right now and smart Americans are using this program to get up to $264,35012 in cash on average! There is NO COST to see if you qualify either.

So while the banks happily wait for this program to end, we are making a nationwide push and urging citizens to take advantage. This program currently exists as of March, but with national economic uncertainty, it could be pulled away from the public at any time. But the good news is that once you're approved, you're in. If getting up to $264,35012 to use however you'd like sounds good, it's vital you act now and see if you could qualify for a cash out refi today.

URGENT: So many people could still benefit today, but sadly, many perceive CoRP to be too good to be true. Remember, the Cash Out Refi Program could allow you to access up to $264,35012 using the equity in your home & there's absolutely NO COST to see if you qualify.

How Do I Check My Eligibility?

This program is only for existing homeowners. If you do not own your home, you will NOT be eligible.

Step 1: Click the year you purchased your home below to instantly check your eligibility for free.

Step 2: If you're eligible, you can continue to get your cash-out offer!

When did you purchase your home?

4. See If Your Credit Card Debt is Eligible for this Special Debt Relief Program

The simple truth is you shouldn’t expect your credit card to tell you about this.

Did you know that if you have at least $20K in credit card debt and have any form of income, you could qualify for this credit card debt relief program? Additionally, the more debt you have, the more you could potentially avoid paying. Has your credit card company ever told you that?

The problem is that you can’t expect credit card companies to tell you this because they’d rather collect their full payment from you.

With economic uncertainty and potential for tariffs and inflation increases, now is the time to check. If you qualify, you could start resolving at least $20,000 in credit card debt and lock in savings before your debt increases. The more debt you have, the more this program could potentially settle.

You could be paying for your home renovations, fund your business, & even take a vacation - All thanks to the savings they could get through this option. Credit Card interest rates are through the roof right now and smart Americans are taking advantage and using this private debt relief plan to settle their high credit card debts! It's 100% free to see if you're eligible, too.

How To See If You Are Eligible

If you have at least $20K in credit card debt, this takes minutes and is free to check!

Step 1: Tap your debt amount below↓

Step 2: Fill out the quick form to find out how much you could potentially reduce or resolve.

Step 3: Speak to a friendly representative. They'll get an understanding of your situation and provide steps on how you can get out of debt.

This program can even help with debt amounts over $50,000 or $100,000!

5. Homeowner? You Could Get Up To $185,000 Cash To Use However You'd Like Thanks To The Government Insured "FaCOP" Refi Initiative12

Why don't more Americans know about this extremely brilliant way to get up to $185,000 however they'd like?

Many American homeowners could now be eligible for this nationwide "FaCOP" program. Those who qualify are accessing up to $185,000 (some qualify for more) to use to pay off debt, buy a new vehicle, make home repairs, and even buy family vacations.

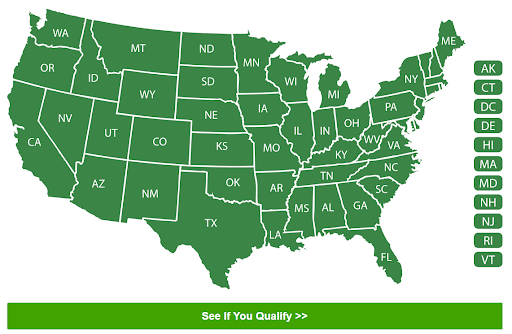

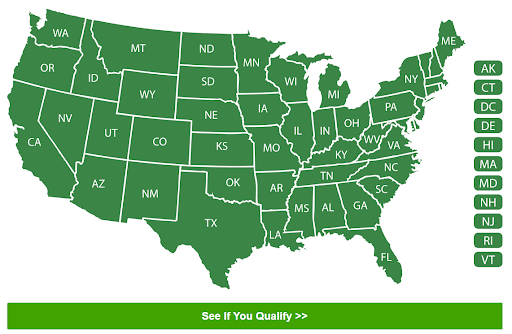

URGENT: This 'FaCOP' program is not offered in al states. Check to see if it's offered in your state today.

The 'FaCOP' program is taking many by surprise. Thousands of Americans have already taken advantage and are enjoying the benefits of this cash infusion.

If you would like to see how much cash you could access, act now.

How Do I Check My Eligibility?

This program is only for existing homeowners. If you do not own your home, you will NOT be eligible.

Step 1: Click the state you purchased your home below to instantly check your eligibility for free.

Step 2: If you're eligible, you can continue to get your cash-out offer!

What state did you purchase your home?

6. Get Up to $100K in 5 Minutes – Even with Bad Credit

Need cash fast? If you earn over $1,500/month, consider a personal loan. Use it for anything—paying off debt, home renovations, or emergencies.

With rates starting at 6.40% APR*, our partner AmONE can help you secure up to $100K, even if your credit score is below 620. It’s quick, doesn’t affect your credit score, and approvals can take as little as 5 minutes.

Why wait? See what you qualify for today!

TOP CHOICE: Why don't more Americans know about this extremely brilliant way to get up to $200,000 in credit card debt settled?

Many Americans could now be eligible for debt relief through a private debt settlement program that's available to those with high credit card debt. Those who qualify are reaping the benefits of resolving up to $200,000 in high interest credit card debt and saving their dollars that would have been wasted in interest payments through this program. What would you do with all of that extra money you saved?

URGENT: This Debt Settlement Program is not offered in all states. Check to see if it's offered in your state today.

This Debt Settlement option is taking many by surprise. Thousands of Americans have already taken advantage and are enjoying their savings. You could use the savings to pay for a family vacation, complete much needed home renovations, and even purchase your family a new vehicle.

If you would like to see how much debt you could qualify to get settled through this program, act now.

How Do I Check My Eligibility?

We've searched the web and found the easiest way to check your eligibility through a secured website. It only takes about 2 minutes to see if you qualify, so it’s very much worth your time. Select your state below and then answer a few questions to check your eligibility.

Follow These Simple Steps To See How Much Debt Relief You Could Get:

If you have at least $20K in credit card debt, this takes minutes and is free to check!

Step 1: Tap your debt amount below↓

Step 2: Fill out the quick form to find out how much you could potentially save

Step 3: Speak to a friendly representative

This program can even help with debt amounts over $50,000 or $100,000!

Is This Debt Relief Program Legit?

Yes. It has an “A+” rating from the Better Business Bureau and a 4.7/5 TrustPilot rating. It has resolved over $3 billion in debt for 170,000+ clients since 2008 and is a member of the Consumer Debt Relief Initiative (CDRI).

What Do You Have to Lose?

Checking eligibility is free, confidential, and risk-free. Your creditors won’t be notified.

Worst case: you don’t qualify, and you lose nothing. Best case: you qualify and begin to resolve your debt.

Imagine the relief of having your debt handled. This could be your future by committing to this program.

The more debt you have, the more this program could resolve—even amounts over $50,000 or $100,000!

Don’t wait—act now to resolve your debt.

How To See If You Are Eligible

If you have at least $20K in credit card debt, this takes minutes and is free to check!

Step 1: Tap your debt amount below↓

Step 2: Fill out the quick form to find out how much you could potentially save

Step 3: Speak to a friendly representative

This program can even help with debt amounts over $50,000 or $100,000!

- $264,350 figure is based on borrowing 85% of the average 2024 Q3 homeowner equity of $311,000 from Corelogic’s Q3 2024 Homeowner Insights Study https://www.corelogic.com/intelligence/homeowner-equity-insights-q3-2024/

- NMLS #3030. Rocket Mortgage, LLC, Rocket Homes Real Estate LLC, and RockLoans Marketplace LLC (doing business as Rocket Loans®) are separate operating subsidiaries of Rocket Companies, Inc. (NYSE: RKT). Each company is a separate legal entity operated and managed through its own management and governance structure as required by its state of incorporation and applicable legal and regulatory requirements. Rocket Mortgage, 1050 Woodward Ave., Detroit, MI 48226-1906

ClearOne Advantage, LLC is a debt settlement company, not a lender, loan broker, creditor, credit services organization, or debt collector. ClearOne Advantage, LLC does not assume or pay any debts; receive, hold or control funds belonging to consumers; or provide bankruptcy, legal, accounting or tax advice. You should review full program terms and conditions before enrolling. To the extent that any aspect of the debt settlement services relies on or results in the consumer’s failure to make timely payments to the consumer’s creditors or debt collectors, the use of the debt settlement services: (1) Will likely adversely affect the consumer’s creditworthiness; (2) May result in the consumer being subject to collections or being sued by creditors or debt collectors; and (3) May increase the amount of money the consumer owes due to the accrual of fees and interest by creditors or debt collectors. Not available in all states. Some third-party fees may apply. C.P.D. Reg. No. T.S. 12-03822.